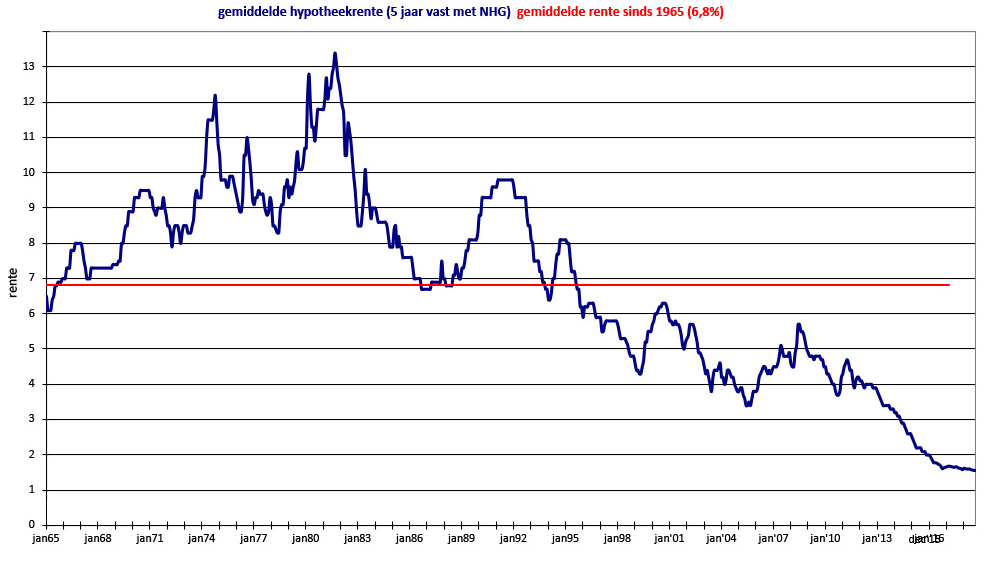

Interest rates on mortgages in Holland have already been sliding for about seven years.

Dutch banks traditionally update their interest rates in August following the propositions by the Ministry of Finance.

According to De Hypotheekshop, the average mortgage IR is 2.18% as of end of August 2019.

Below are the historical rates over the last half a century. This is a chart for a five-year fixed rate:

Apart from the record low values, what is also remarkable is their update frequency. Some mortgage providers have reduced them four times during last month.

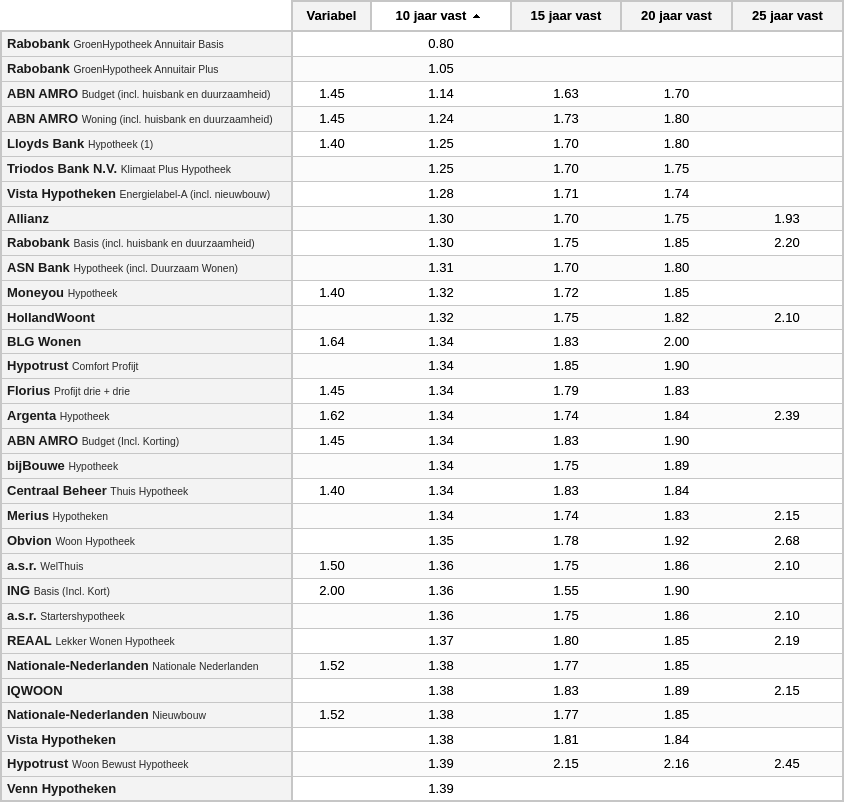

Starting at 0.8%

You can find a handy overview of applicable rates for various fixed terms on this page.

Here’s an example calculation for a mortgage of € 300,000 (which is approximately the average house price at the moment), with the National Mortgage Guarantee (NHG) provisioning. Rates start at 0.8% when you choose for 10-year fixed:

Withouth the National Mortgage Guarantee the rates start at 1.2%.

The fact the variable rates are higher than the 10-year fixed indicates the market is expecting they will continue to slide.

NHG

NHG (Nationale Hypotheek Garantie) or the National Mortgage Guarantee is a sort of an insurance policy that provides a safety net for the borrower. The NHG can pay the difference between the remaining principal and the house sale price, should it prove lower than the debt. It also allows to temporarily reduce the monthly payments if the debtor runs into financial difficulties, but only if it’s been an event beyond their control.

The maximum amount covered by the guarantee equals the average house price. In 2019 it’s defined at € 290,000. If you, however, plan to make your new house more energy-effective, then the limit is € 307,400.

The credit risk of an NHG-backed mortgage is lower, hence a lower interest rate. ■

— world’s fastest URL shortener

— world’s fastest URL shortener

Comments